Taxable income formula

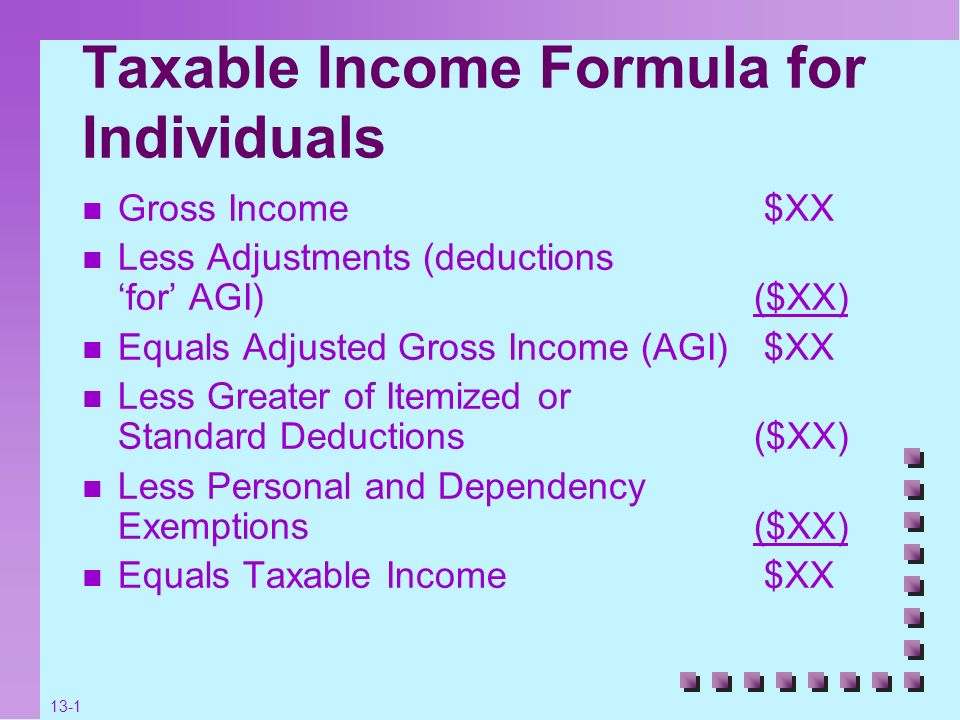

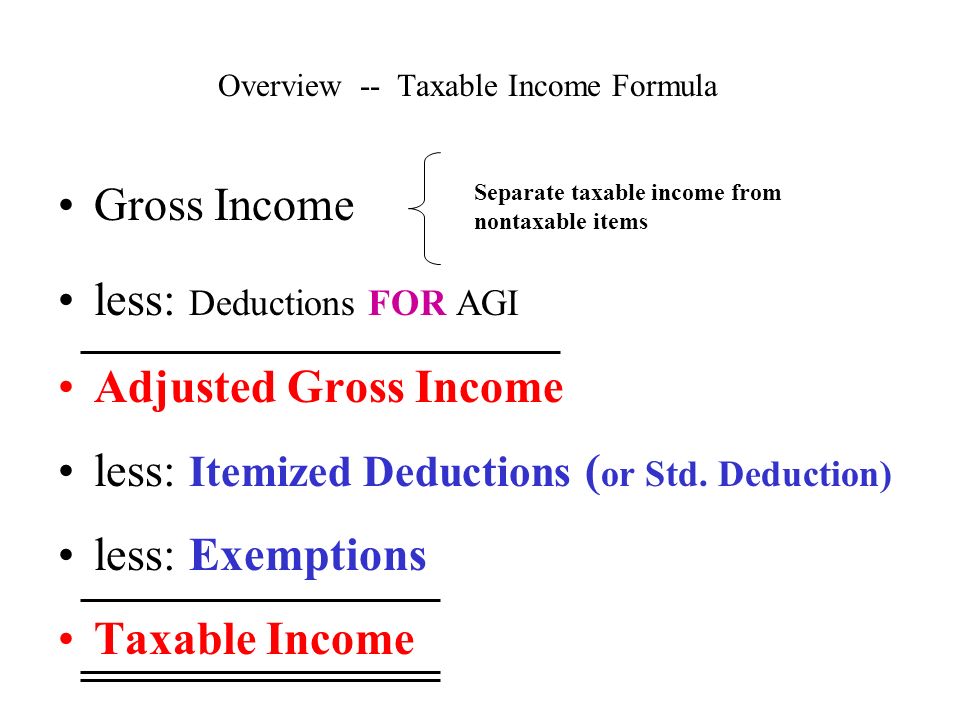

Calculate Your Gross Income. Taxable income is defined by Internal Revenue Code IRC section 63 on gross income less allowable deductions.

Taxable Income Formula For Individuals Ppt Video Online Download

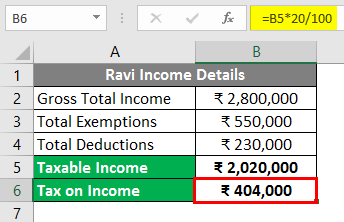

The tax levied on every individual is different depending on their income.

. Again you explain the. Divide the companys total tax liability by the statutory tax rate listed on the governments tax table to. Income tax is calculated for a business entity or individual over a particular period usually over the financial year.

An amount of money set by the IRS that. Ad See If You Qualify To File For Free With TurboTax Free Edition. Add up all sources of taxable income such as wages from a job income from a side hustle investment returns etc.

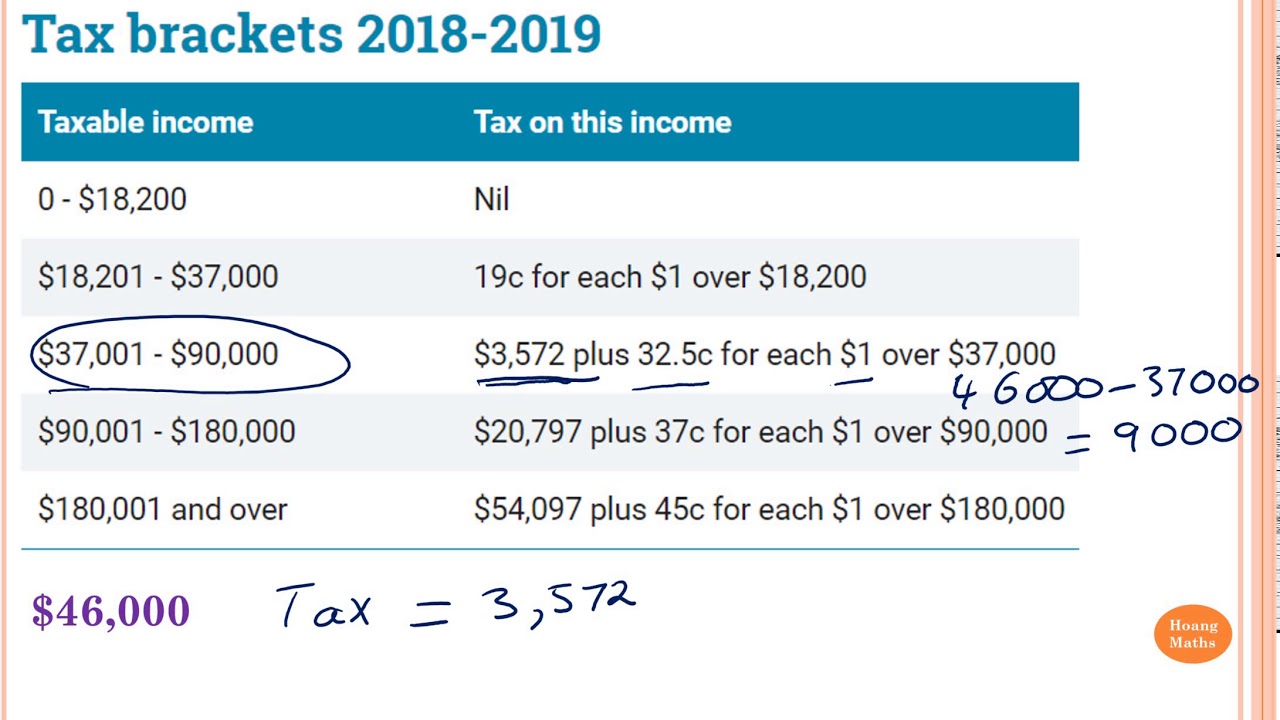

The tax payable will be thus 19950. Then use a simple formula from the IRS website to determine how much of the total gross monthly income should be taxed at the federal level and how much at the state. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition.

Revenues is any income your business earns. Its a simple formula you tell him. For taxpayers making between 146401 and 223050 the tax bracket is 28 percent.

Revenues Deductions Taxable Income. There are generally used equation which is derived from the income statement. In general any revenue is taxable.

Income Tax Payable for an. Taxpayers making between 72501 and 146400 pay 25 percent of all income in excess of 72500. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

The first 9950 is taxed at 10 995. For people who are self. This formula is simply the tax rate multiplied by the taxable income of the.

The next 30575 is taxed. These are the most common types of taxable income and include wages and salaries as well as fringe benefits. To illustrate say your.

Gross Profit Revenue Cost of Goods Sales COGS Operating profit Earnings before Interest. The first step in computing your AGI is to determine your total gross income for the year which includes your salary in addition to any earnings from self. Investment and business income.

Therefore the taxable income becomes more than 57000 510006000 calculated with the same tax rate of 35. Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. Allowable deductions from gross income including certain employee personal retirement insurance and support expenses.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Taxable income only represents the taxable portion of a companys profits. The tax levied is governed by Indian Income Tax Act 1961The income tax received by taxpayers is the main.

You can think of it like a formula.

Chapter 3 Calculate Taxable Income Personal And Dependency Exemptions Ppt Video Online Download

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

Income Tax Formula Excel University

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Framework Youtube

Taxable Income Formula Examples How To Calculate Taxable Income

Calculating Tax Payable Part 1 Youtube

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Calculate Income Tax In Excel How To Calculate Income Tax In Excel